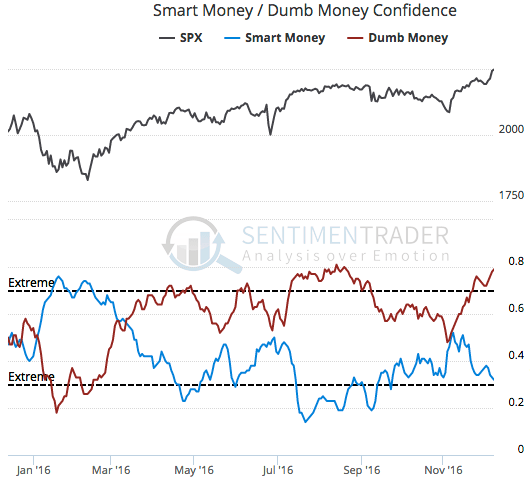

It appears that the little hiccup is behind us and the market’s bullish technicals and price are enticing the little guy not to be so skittish. The new leg up, making our S&P 500 target of 2410 look ever more doable, has gotten the Dumb money back to its recent highs. From Sentimentrader…

Looking at a couple of groups (source: Yardeni.com), we find that the newsletter writers surveyed by Investors Intelligence were still robustly bullish this market as of Dec. 6. It’s a sure bet they are more so now. This group is not as skittish as the ‘Dumb’ money aggregates above or the AAII, below. The Investors Intelligence group is a more sophisticated trend follower, but ultimately will prove a contrary indicator when things change. Click the thumbnail to access the Yardeni report containing this info…

Finally, the American Association of Individual Investors reduced its spiked up bullishness a bit as of 2 days ago. It’s a good bet they are bulling briskly again now.

I don’t think it is a coincidence that that AAII spiked at the same time that the Russell 2000 spiked, or this ‘micro cap’ ETF (the average market caps in this fund are much larger than what some of us might call “micro”, but the point is the same… ).

Junk to Treasury and Junk to Investment Grade show a big risk ‘on’ trade in process.

That goes with our view of a manic atmosphere that sucks the AAII back in as perhaps the final participant in the great post-2008 bull market.

And to think, it is all compliments of a great psychological reset brought on by a profound change in American politics. It is as if the markets (stocks, building material commodities, various industries thought to benefit from the changes, etc.) are trying to fully discount a once again “great” America all in one big gulp. It’s manic behavior, folks.

I am participating with the idea of said SPX 2410 target in mind, but risk is rising strongly now.

Subscribe to NFTRH Premium for your 30-45 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter @BiiwiiNFTRH, StockTwits or RSS.